Malaysia Tax Rates And Chargeable Income YA 2021 Meanwhile heres the updated list of income tax rates that individual taxpayers are required to pay for YA 2021 based on their chargeable income. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Income taxes in Malaysia are designed to be territorial which means an individual or entity is taxed only on incomes earned.

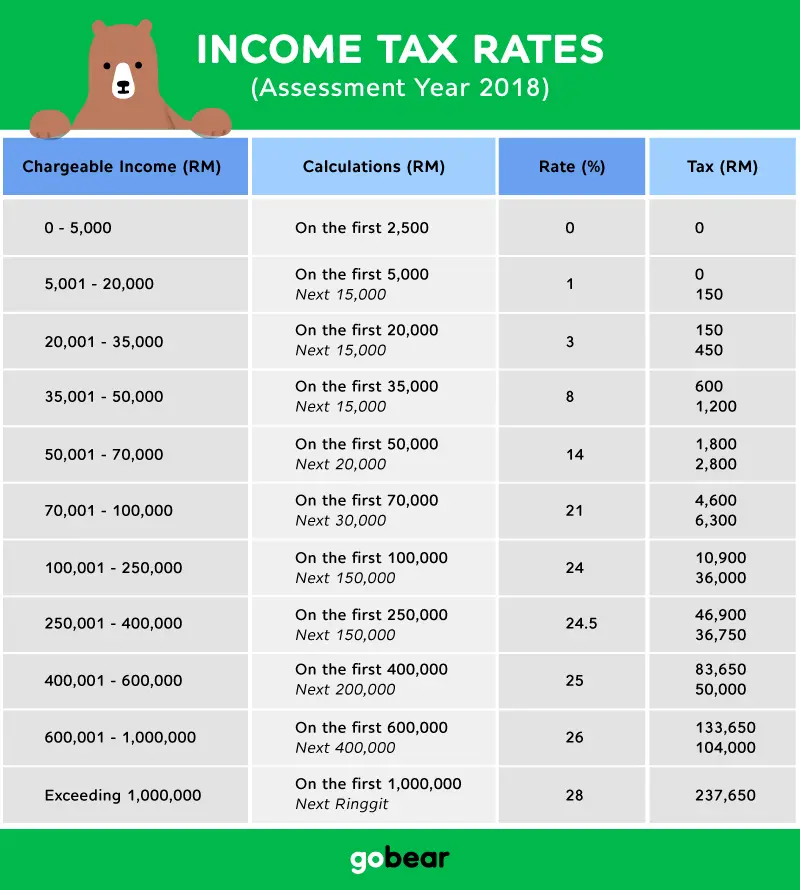

. The system is thus based on the taxpayers ability to pay. Chargeable Income RM Calculations RM Rate Tax RM 0 5000. Chargeable income RM20000.

Income tax rates 2022 Malaysia. Personal Tax 2021 Calculation. 2020 income tax rates for residents.

This page provides - Malaysia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Resident individuals are eligible to claim tax rebates and tax reliefs. Personal Income Tax Rate in Malaysia averaged 2729 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015.

On the First 5000. Income tax in Malaysia is a progressive tax which means that the amount of tax paid increases as income increases. For 2022 tax year.

On the First 5000 Next 15000. 0 to 5000 Tax rate. 0 Taxable income band MYR.

How Much To Pay. During the transitional period from 1 January 2022 to 30 June 2022 foreign-sourced income of tax residents remitted to Malaysia will be taxed at 3 on gross income. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained.

Annual income RM36000. This page provides - Malaysia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Total tax reliefs RM16000.

Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment. Tax Rates for Individual.

Choose a specific income tax year to see the Malaysia income tax rates and personal allowances used in the associated income tax. Malaysia Non-Residents Income Tax Tables in 2022. Tax rates range from 0 to 30.

The following rates are applicable to resident individual taxpayers for YA 2021. There are also special rates for certain types of income such as dividends and capital gains. 13 rows Personal income tax rates.

The Personal Income Tax Rate in Malaysia stands at 30 percent. Estimate your Gross Annual Income. Malaysia Non-Residents Income Tax Tables in 2019.

Our calculation assumes your salary is the same for 2020 and 2021. Personal income tax rates. Total tax amount RM150.

Value on 31122020 Country. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Latest data on 18082022.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Inland Revenue Board of Malaysia. Rate Public Entertainers professional income. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

Income Tax Rates and Thresholds Annual Tax Rate. Personal Income Tax Rate in Malaysia averaged 2729 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. Calculations RM Rate Tax RM 0 - 5000.

On the First 5000. Income Tax Rates and Thresholds Annual Tax Rate. Individual Life Cycle.

The Personal Income Tax Rate in Malaysia stands at 30 percent. Your personal tax guide for Malaysia Home. Data for comparison for the selected period is not available.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Country region guides. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. Taxable income band MYR. Taxes for Year of Assessment 2021 should be filed by 30 April 2022.

Introduction Individual Income Tax. Taxable Income MYR Tax Rate. Malaysia Personal Income Tax Rate annual UTC3.

Flat rate on all taxable income. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Calculations RM Rate TaxRM A.

Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. You need to request access. Ali work under real estate company with RM3000 monthly salary.

Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Malaysia. On the First 5000 Next 15000. Max historical depth is 10 years.

Taxable income band MYR.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Calculate Foreigner S Income Tax In China China Admissions

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Everything You Need To Know About Running Payroll In Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Income Tax Rates Malaysia Maximilliandsx

Individual Income Tax In Malaysia For Expatriates

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Malaysia 2018 Mypf My